Big moves took shape this past week in financial markets. Major central banks such as the Fed, Bank of Canada, Bank of England and Bank of Japan have made changes to their monetary policies. Economic data this week also played a huge role alongside major stock market moves.

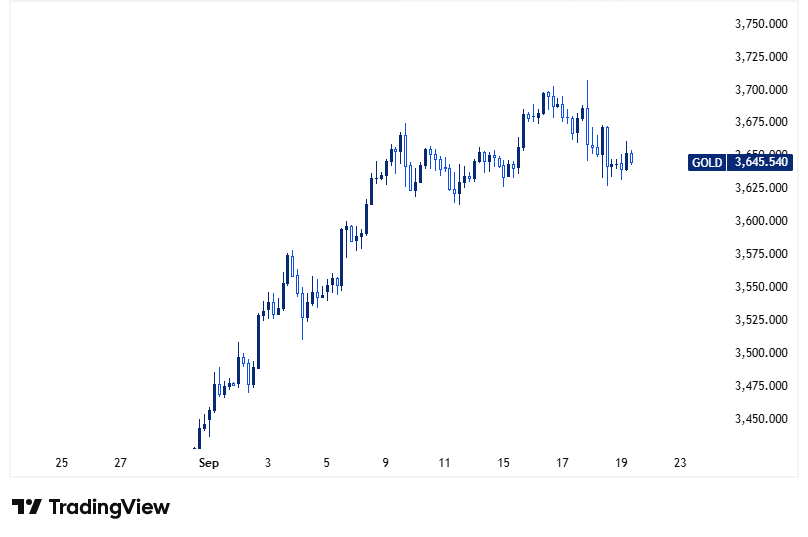

Federal Reserve Cuts Rates, Bringing Gold Down & Supporting USD

The Federal Reserve cut interest rates by 25 basis points on Wednesday, bringing the Fed Funds Rate to 4%. The Fed noted that economic activity has moderated, with job growth slowing down and inflation remaining elevated.

The Fed’s dot plot indicates two more rate cuts by the end of 2025 with no rush to ease. Opinions among Fed officials remain divided as this signals uncertainty about the US economy’s path forward, especially as the labor market weakens and inflation persists.

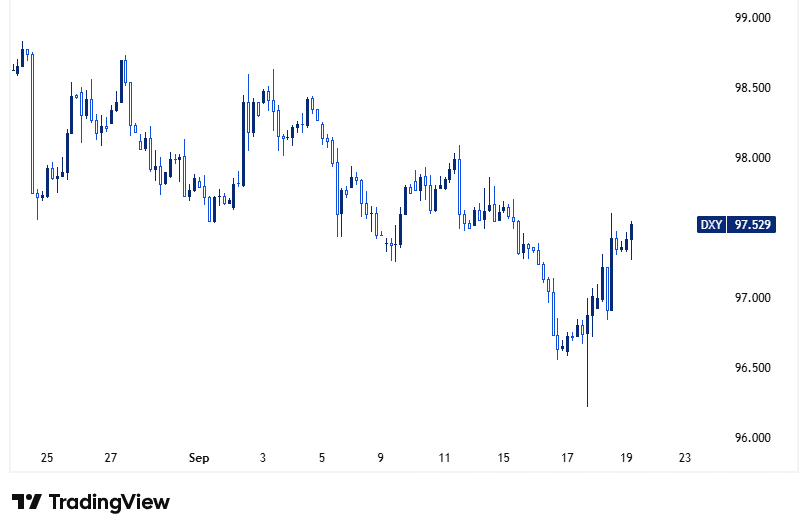

After the announcement, gold declined 1.3% from $3,685 to $3,637, but slightly rebounded afterwards. The US dollar index rebounded following its plunge to a 3.5 year low as traders grappled with the cautious stance of the Federal Reserve’s move on interest rates.

Source: TradingView, Gold Price Chart

Source: TradingView, US Dollar Index Price Chart

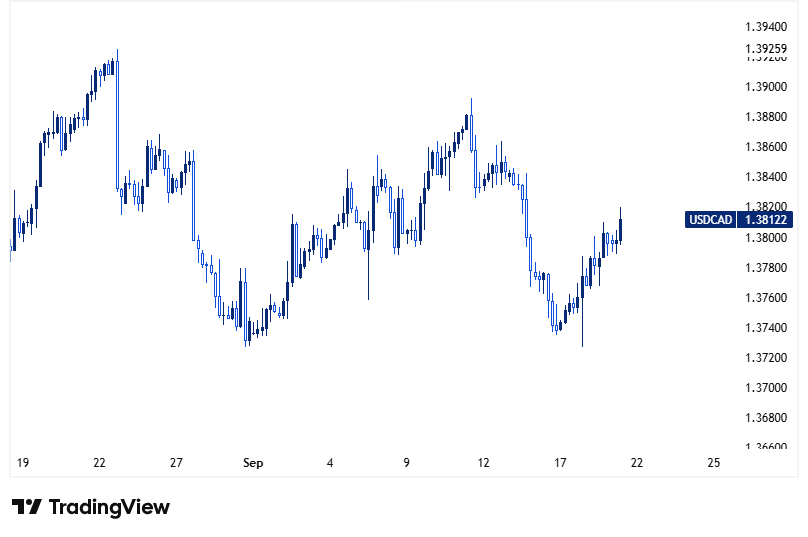

Bank of Canada Delivered an Expected Rate Cut, Assessing Economic Risks

The Bank of Canada reduced interest rates by 25 basis points to 2.5% as expected by markets. But the BOC didn’t offer much guidance on future cuts. BOC Governor Macklem stated that imposing tariffs against the US has eased inflationary pressures. However, economic growth remains weak, with investments stalling due to economic uncertainty. ⁽¹⁾

The Canadian dollar weakened 0.22% against the US dollar as the Bank of Canada and the Federal Reserve resumed their interest rate cutting campaigns.

Source: TradingView, USD/CAD Price Chart

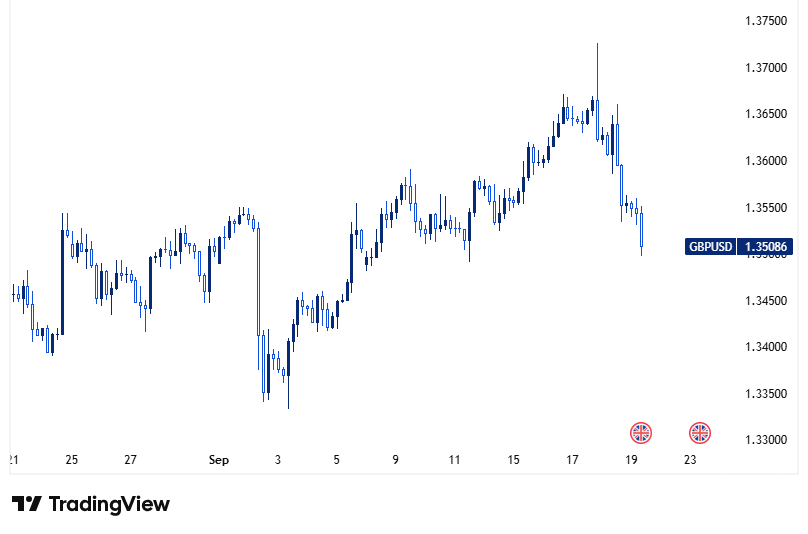

Bank of England Holds Rate Steady, Citing Economic and Political Uncertainty

The Bank of England voted to keep interest rates on hold on Thursday, as it weighs up sticky UK inflation with an uncertain growth outlook and jobs market.

The Monetary Policy Committee (MPC) voted by 7-2 to keep rates steady at 4%, with two members of the MPS in favor of reducing interest rates by 25 basis points. The September decision to hold rates was widely expected, after the BOE reduced rates by 25 basis points in August. ⁽²⁾

The BOE has forecast that inflation could peak at 4% in September, double its 2% target, before retreating in the early half of 2026. The central bank also moved to slow down the pace at which it is offloading UK government bonds. ⁽³⁾

Uncertainty looms over the November 26 Autumn Budget, where Finance Minister Rachel Reeves is expected to unveil tax hikes to plug the deficit. The BOE meets earlier on November 6, just weeks before the budget. ⁽⁴⁾

The Pound Sterling extended declines today, dropping 1% against the US dollar.

Source: TradingView, GDP/USD Price Chart

Bank of Japan Holds Rates Steady, Starts Selling ETF Holdings

The Bank of Japan left interest rates unchanged, needing to assess persistent economic and political uncertainty and announced that it will begin selling its ETF holdings worth ¥330 billion. ⁽⁵⁾

The decision, passed by a 7-2 vote, came amid risks tied to Japan’s political outlook and the impact of US tariffs. It followed the US Fed’s first rate cut since December 2024.

The lack of monetary policy changes on Friday was widely expected after Prime Minister Shigeru Ishiba’s resignation declaration kicked off a race for his successor, roughly a year after the last leadership election. BOJ officials are still assessing the impact of US tariffs domestically and abroad even after Japan managed to solidify its US trade deal. ⁽⁶⁾

The yen strengthened against major currencies, rising 0.3% against the US dollar after the Bank of Japan delivered a hawkish surprise.

Mixed Economic Data

This week’s economic data showed a mixed picture for central banks. In the UK, GDP slowed to 0.2% while the unemployment rate rose to 4.7% and inflation remained high at 3.8%.

Canada saw a decline in inflation at 1.9%. In the US, jobless claims declined to 231k, below expectations while retail sales showed strong figures of 0.6% MoM. Japan’s core CPI rose 2.7% YoY in August, data showed on Friday, slowing for the third straight month and remaining above the central bank’s 2% target. ⁽⁷⁾

Australia and New Zealand faced weak data, with Australia’s labor market report indicating job losses and a steady unemployment rate. Meanwhile, New Zealand’s economy faced a contraction of -0.9%. The GDP drop supports expectations of a rate cut from the RBNZ in October. ⁽⁸⁾

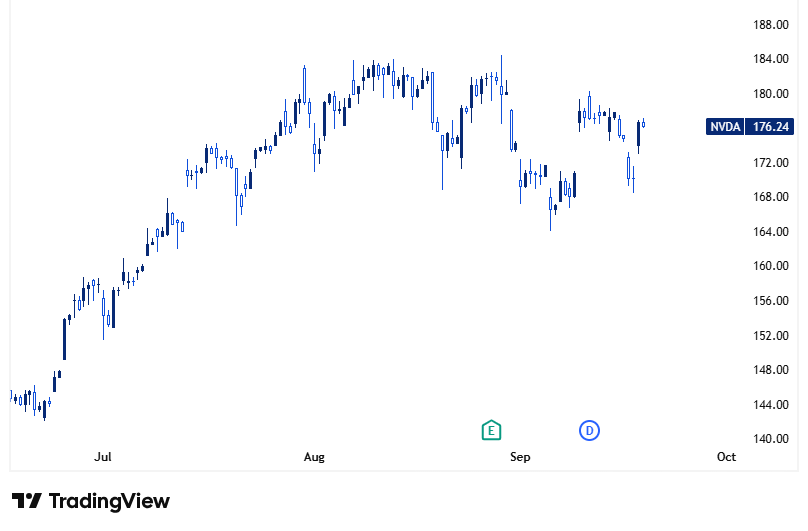

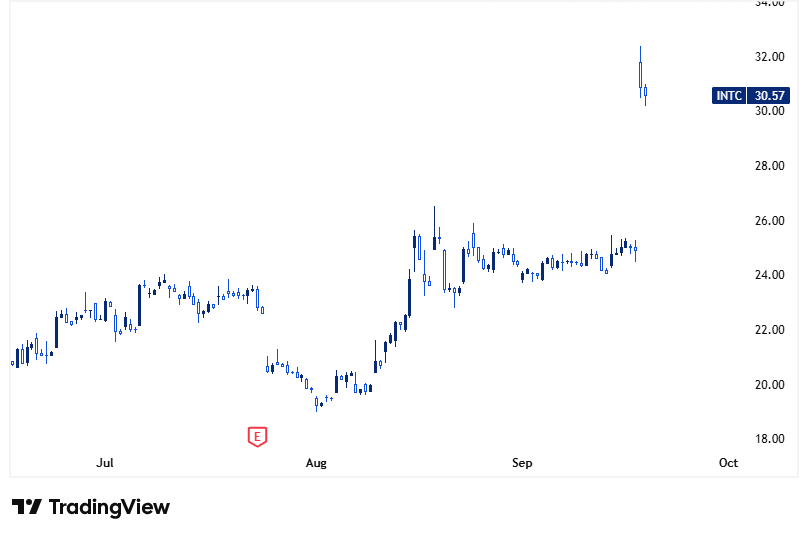

Nvidia Buys $5 Billion Stake in Intel, Sending Tech Stocks Higher

Nvidia said it will invest $5 billion in Intel as part of a deal to co-develop data centers and PC chips with the troubled chipmaker, which took on the US government as an investor last month.

Intel shares, which hit its lowest level in more than a decade earlier this year, rebounded after finding renewed support from the Trump administration, striking a deal for the US government to invest a 10% stake in the chipmaker in August. ⁽⁹⁾

Both tech titans rose on Thursday, with Nvidia rising 3.5% while Intel rose more than 22%. The NASDAQ 100 rose 0.94%, lifted by both companies.

Source: TradingView, Nvidia Price Chart

Source: TradingView, Intel Price Chart

For next week, important economic data is set for release, including:

- EU, UK and US Flash PMI Data

- AU CPI

- Swiss National Bank Interest Rate Decision

- US Final Q2 GDP

- JP Tokyo CPI

- US Core PCE Index