The Federal Reserve announced on Wednesday that the FOMC has decided to lower interest rates by 25 basis points, reacting to concerns about labor market risks and persistent inflationary pressures in the US.

The decision was widely expected by markets, with the Fed indicating two more possible rate cuts by year’s end.

Breaking Down the Decision

The FOMC voted 11-1 to cut interest rates by 25 basis points, setting the Fed Funds Rate between 4-4.25%. The newly appointed Fed Governor Stephen Miran was the only one who pushed for a 50-basis point cut, which was surprising since many had thought that Christopher Waller and Michelle Bowman would also vote for a larger cut.

Although the lone dissenting voice calling for a 50-basis point cut could be seen as relatively hawkish, the market is taking the Fed decision in its stride. ⁽¹⁾

Members who were appointed by President Donald Trump, who has criticized the Fed all summer to cut not merely in its traditional 25 basis point moves but to lower the Fed Funds Rate quickly and aggressively. ⁽²⁾

Economic Slowdown and Projections

The Fed stated that economic activity has slowed, with the labor market weakening and inflation remaining persistently high. These factors continue to create headaches for the Fed’s dual mandate goal of price stability and maximum employment. The FOMC’s statement highlighted risks to employment, stating that uncertainty remains high. ⁽³⁾

Fed Chair Powell described the rate cut as a risk management cut to balance these concerns.

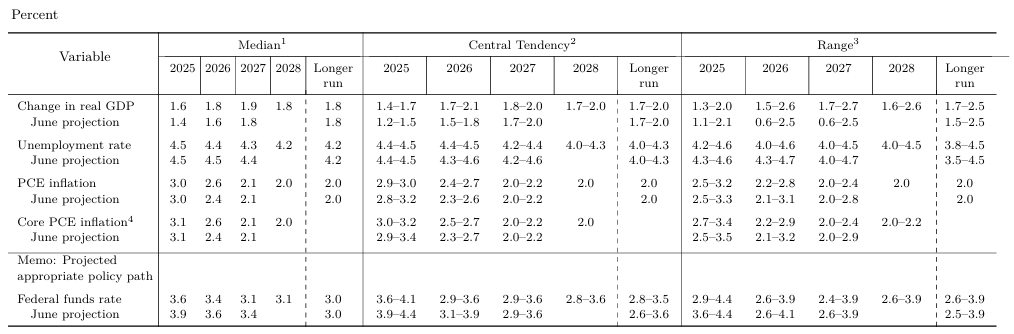

Alongside the policy decision, the Fed released updated economic forecasts in its Summary of Economic Projections, offering fresh insight into how officials expect growth, inflation and unemployment to evolve in the months ahead.

Source: Federal Reserve Statement Economic Projections

The Fed raised its forecasts for economic growth at the end of the year and kept its forecast for inflation and unemployment steady, although the Fed did say in its policy statement that the downside risks to employment have risen. ⁽⁴⁾

Future Interest Rate Expectations

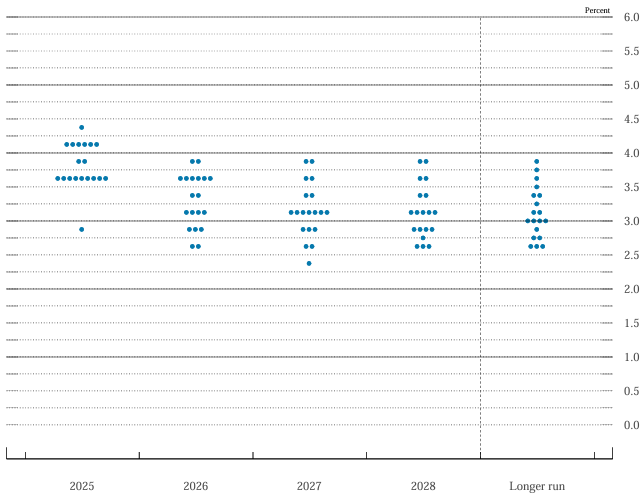

The Fed’s dot plot chart, which shows individual members’ future rate expectations, indicates two more rate cuts by year’s end. However, opinions continue to vary, with nine members expecting one more cut while ten are expecting two. One wants a larger rate cut, which could possibly be Governor Miran. ⁽⁵⁾

Source: Federal Reserve Dot Plot Chart

The Fed’s dot plot includes projections from 19 participants, 7 Fed Governors and 12 Federal Reserve Bank presidents. The plot indicated one cut in 2026, significantly slower than the current market pricing of three. Traders had fully priced in this week’s move. Officials also indicated another reduction in 2027, as the Fed approaches a long-run neutral rate of 3%. ⁽⁶⁾

Markets were Mixed

Global stock markets steadied on Thursday after the decision, but investors were cautious after the Fed signaled a measured approach to further monetary policy easing.

During the press conference, Fed Chair Jerome Powell tempered the more aggressive easing expectations in markets, saying Wednesday’s move was a risk-management cut and that the central bank does not need to move quickly on rates.

Gold tumbled more than 1% due to the priced-in rate cut and cautious moves, while the US dollar index regained some ground above 97.

Traders are pricing in an 87.7% chance of another 25-bp cut at the Fed’s next meeting in October, compared to a 74.3% probability a day earlier. ⁽⁷⁾