With a new trading week comes new opportunities. So, we’ve gathered insights for the week ahead that highlight the current trends, scheduled events and potential movers to watch. Let’s get started.

Calendar Events

Calendar Events

Calendar Events

Calendar Events

Calendar Events

Top Things to Watch

Flash PMI Data Set to Move Markets

BOE Governor Bailey Speech – September 22 Eurozone Flash PMI – September 23

UK Flash PMI – September 23

US Flash PMI – September 23

AU CPI – September 24

BOJ Meeting Minutes – September 25

SNB Interest Rate Decision – September 25

US Final Q2 GDP – September 25

US Initial Jobless Claims – September 25

JP Tokyo CPI – September 26

US Core PCE Index – September 26

Flash PMI readings from the EU, UK and US will be released on Tuesday and could spark market moves. These surveys track performance in the manufacturing and services sectors, offering an early signal of how well economies are holding up.

Swiss National Bank Interest Rate Decision

The SNB is expected to keep rates unchanged at 0% Thursday. With Inflation stabilizing near target, and growth remaining resilient, it leaves the SNB little need for policy action now. SNB Chairman Martin Schlegel has emphasized that there is a high threshold for reintroducing negative interest rates.

US Economic Data

Economic data from the US comes out on Friday, including the final Q2 GDP report and Core PCE Index for August. Q2 GDP is forecasted at 3.3% QoQ while the Fed’s preferred inflation gauge is expected at 0.2% MoM. These reports could shape the Fed’s outlook and signal whether policymakers are likely to continue cutting rates.

Fed Officials on the Mic

Several Fed officials are speaking this week, including John Williams, Thomas Barkin, and Lisa Cook. Markets will watch closely for fresh clues on inflation, growth, and how quickly the Fed might move toward additional cuts.

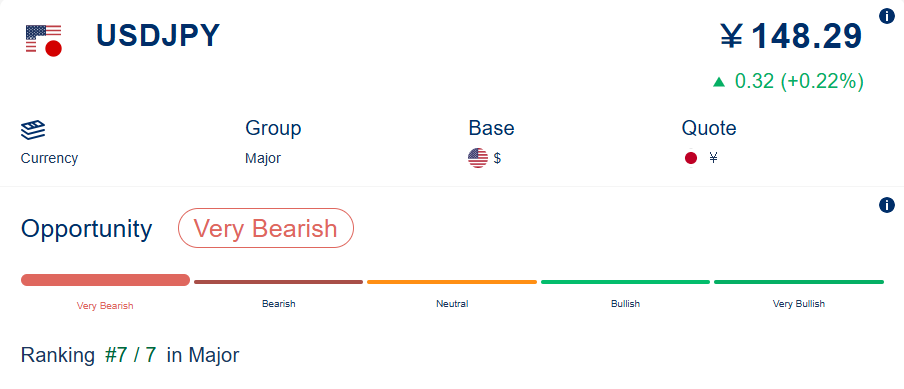

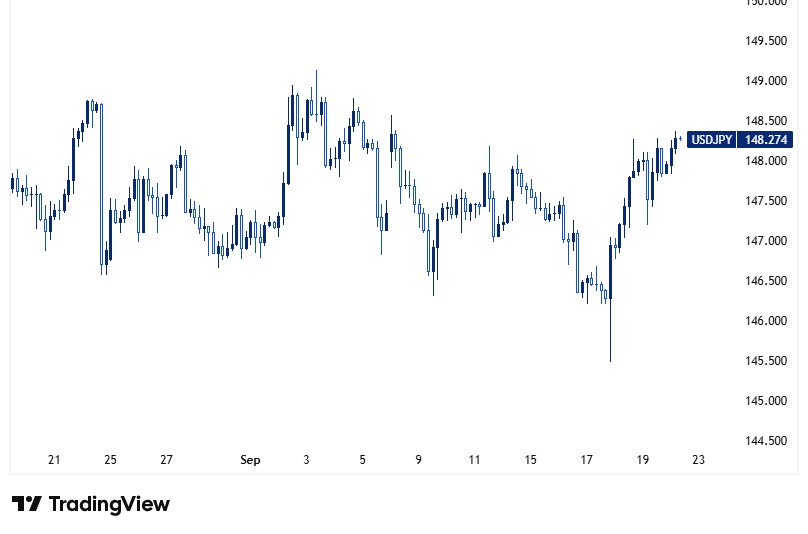

Trending Now: USD/JPY

Source: Acuity

Source: TradingView

Why It’s Trending?

USD/JPY is trying to regain ground toward September highs as the dollar strengthens on the Fed’s cautious easing stance, signaling no rush to cut rates. Traders will be watching speeches from Fed officials this week for further clues on policy, though renewed concerns over the Fed’s independence could limit upside for the greenback. On the yen side, the BOJ kept rates unchanged at 0.5% last week, as expected. Policymakers noted that Japan’s economy is recovering moderately but highlighted lingering weaknesses and risks tied to global trade policies.