Recent data from the US, China, Europe and Japan has shaped markets this week, with mixed inflation data, a tech rally, political factors and stock market gains.

In the US, wholesale prices fell, which may help the Federal Reserve when it comes to cutting interest rates. China faces deflation in consumer prices but sees some easing in producer prices and a stronger yuan. Tech news boosted stocks, with Oracle surging to new highs. Here’s what happened during the week.

US Inflation Remains Sticky

US consumer prices rose more than expected in August. The annual increase in inflation was the largest in seven months, but the data is not expected to prevent a much-anticipated interest rate cut from the Federal Reserve next week against the backdrop of labor market weakness.

CPI rose 0.4% MoM after increasing 0.2% in July. Meanwhile on a yearly basis, CPI rose 2.9%, the largest increase since January, after climbing 2.7% in July. Core CPI matched estimates at 0.3% MoM, higher than July’s 0.2% and 3.1% YoY matched estimates. The CPI report could reduce concerns of stagflation following recent downbeat news on the labor market. ⁽¹⁾

A noticeable easing of President Trump’s sweeping tariffs has been gradual, but prices could accelerate in the months ahead as businesses have depleted their pre-tariff inventories.

US Wholesale prices fell in August, Wednesday’s report showed. Both headline and core PPI dropped 0.1%, after a 0.7% MoM increase in July. PPI YoY came in at 2.6% and core PPI at 2.8%, less than forecasted.

The weak producer prices data gives more support for bets of rate cuts from the Federal Reserve next week, where markets are pricing in a 100% chance that the Fed will cut rates. ⁽²⁾

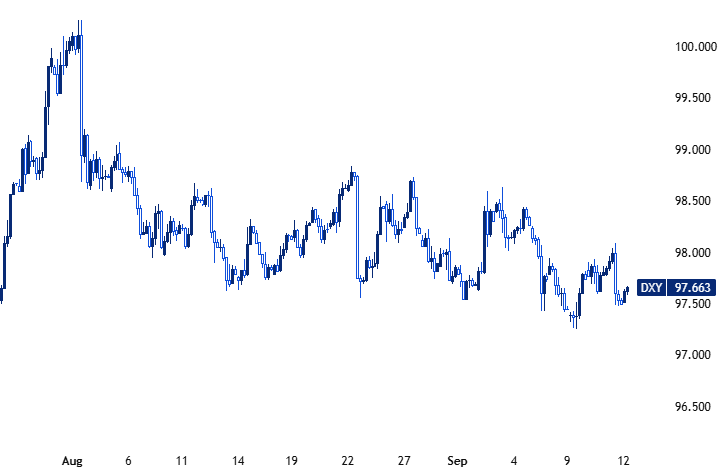

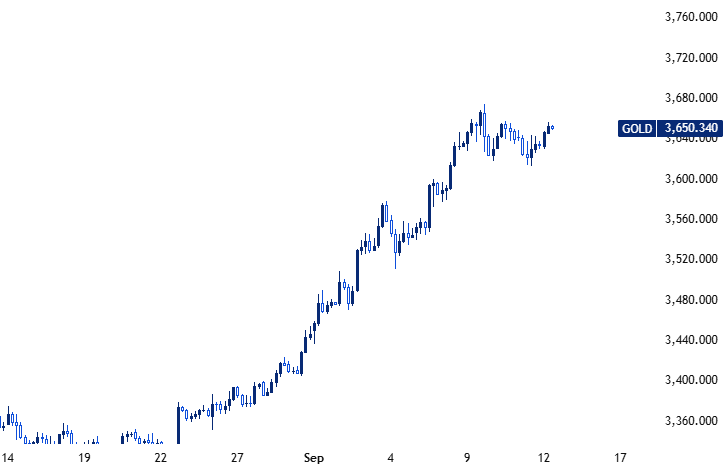

The US dollar index steadied after the release but kept under pressure as the latest inflation print came in line with expectations, giving the Federal Reserve room to ease policy amid a slowing labor market. Gold moved toward its record high and has remained on track for a fourth consecutive weekly gain, as expectations of looser US monetary policy held firm.

Source: TradingView Chart Showing US Dollar Index

Source: TradingView Chart Showing Gold

ECB Holds Rate, Assessing Data in Each Meeting

The European Central Bank kept rates unchanged at 2.15% on Thursday as uncertainty over the economy remains due to US President Trump’s aggressive tariff policies. The ECB added that it would become data-dependent and assess them meeting by meeting, with no specific trajectory for interest rates. ⁽³⁾

“Inflation is currently at around the 2% medium-term target and the Governing Council’s assessment of the inflation outlook is broadly unchanged,” the ECB said in a statement.

The ECB is grappling with global economic uncertainty, despite inflation in the euro zone remaining around the central bank’s 2% target in recent months, and the EU striking a trade agreement with the US.

The US agreed to 15% blanket tariffs on EU exports to the US in July, with further details about the framework emerging last month. It addressed some questions for key European sectors like pharmaceuticals. The ECB has left the door open for further rate reductions, according to economists and analysts following the interest rate decision. ⁽⁴⁾

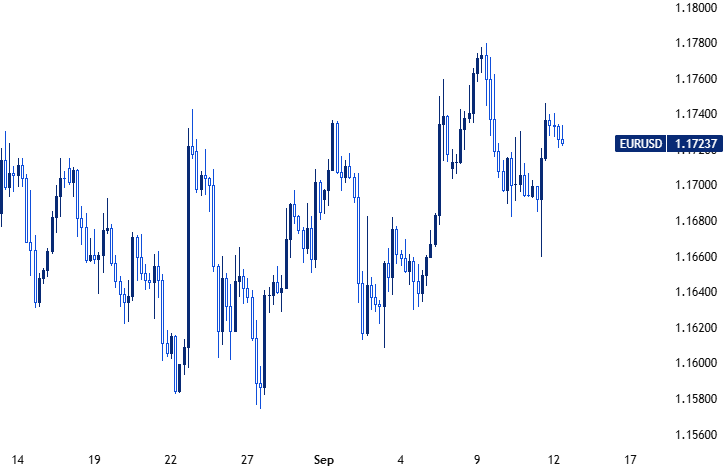

The euro rose 0.5% against the US dollar on a hawkish ECB combined with expectations of a rate cut from the Federal Reserve.

Source: TradingView Chart Showing EUR/USD

China Continues to Face Deflation

China’s CPI continues to fall as the CPI for August dropped more than expected. Deflation in wholesale prices also continued. CPI came in at -0.4% YoY and turned out flat on a monthly basis. PPI came in at -2.9%, higher than expected, reaching the highest level since February 2024. China said that CPI fell due to high interest rates and low food prices, as consumer prices fell at their fastest pace in six months. ⁽⁵⁾

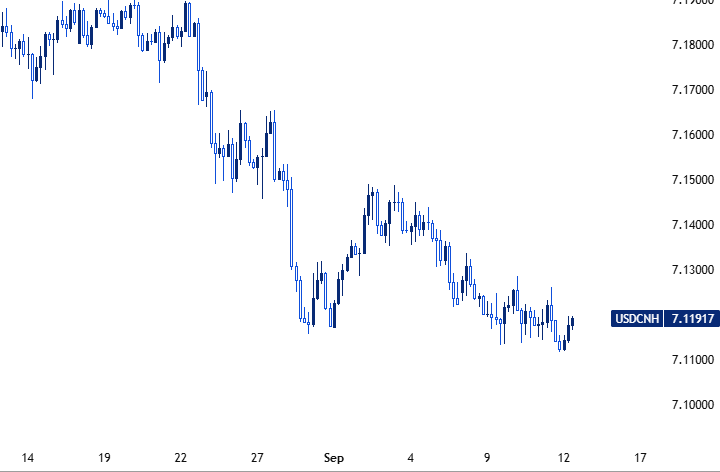

The Chinese yuan closed at its highest level in 10 months on Wednesday as it recovered losses from the weak inflation figures.

Source: TradingView Chart Showing USD/CNH

Oracle’s Massive Stock Surge

The past week also saw Oracle stock skyrocket 36% on Wednesday, lifting tech stocks along with it. The company’s stock hit a record high after the results of its strong cloud demand, despite an earnings miss. After the bell, Oracle said that it has $455 billion in remaining performance obligations, up 359% from a year earlier. ⁽⁶⁾

Oracle has been one of the biggest benefactors of the artificial intelligence boom thanks to its cloud infrastructure business and access to Nvidia’s graphics processing units, or GPUs, which are both needed to run large workloads. But competition is fierce, and Oracle is jostling with other cloud providers like Microsoft, Amazon and Google for customers. ⁽⁷⁾

Oracle now sees $18 billion in cloud infrastructure revenue in fiscal 2026, with the company calling for the annual sum to reach $32 billion, $73 billion, $114 billion and $144 billion over the subsequent four years. ⁽⁸⁾

Source: TradingView Chart Showing Oracle Stock

Important Events to Watch Next Week

As we gear up for the week ahead, here are some of the most important data points to watch out for.

- UK Labor Market Data and CPI

- Canada CPI

- US Retail Sales

- Bank of Canada Interest Rate Decision

- FOMC Meeting

- New Zealand GDP

- Australia Labor Market Data

- Bank of England Interest Rate Decision

- Bank of Japan Interest Rate Decision