The Bank of Japan (BOJ) will announce its interest rate decision this Friday, September 19th. The central bank is expected to keep rates unchanged at 0.5% as it assesses factors like political instability, economic concerns and US tariffs.

While the central bank remains optimistic about Japan’s economy, uncertainties from US economic performance and political developments in Japan have caused the BOJ to become more cautious.

Holding Rates Amid Political Uncertainty

The expected decision to hold rates follows Prime Minister Ishiba’s resignation, adding more political uncertainty to the Bank of Japan’s plans, especially from the loss of the Upper House elections and trade concerns with the US.

The ruling Liberal Democratic Party (LDP) still lacks a parliamentary majority, with a new LDP leader to be voted in on October 4th.⁽¹⁾

While the BOJ is unlikely to address Ishiba’s resignation to maintain central bank independence, markets expect political developments to influence the board’s plans. Some analysts expect the BOJ to delay a rate hike that is expected in October due to political uncertainty. ⁽²⁾

US Tariffs and Economic Impacts

The BOJ continues to monitor the impacts of US tariffs on Japanese goods, especially after a trade deal that resulted in a tariff rate of 15% on vehicles. While Japan’s revised GDP report showed stronger than expected growth and inflation remaining well above the BOJ’s 2% target for three years, tariffs could pose risks to corporate profits.

Japanese manufacturers saw profit declines between April and June, due to weak employment data. This could press corporate earnings in Japan by disrupting wage growth and the BOJ’s goal of maintaining growth. ⁽³⁾

Inflation Goals

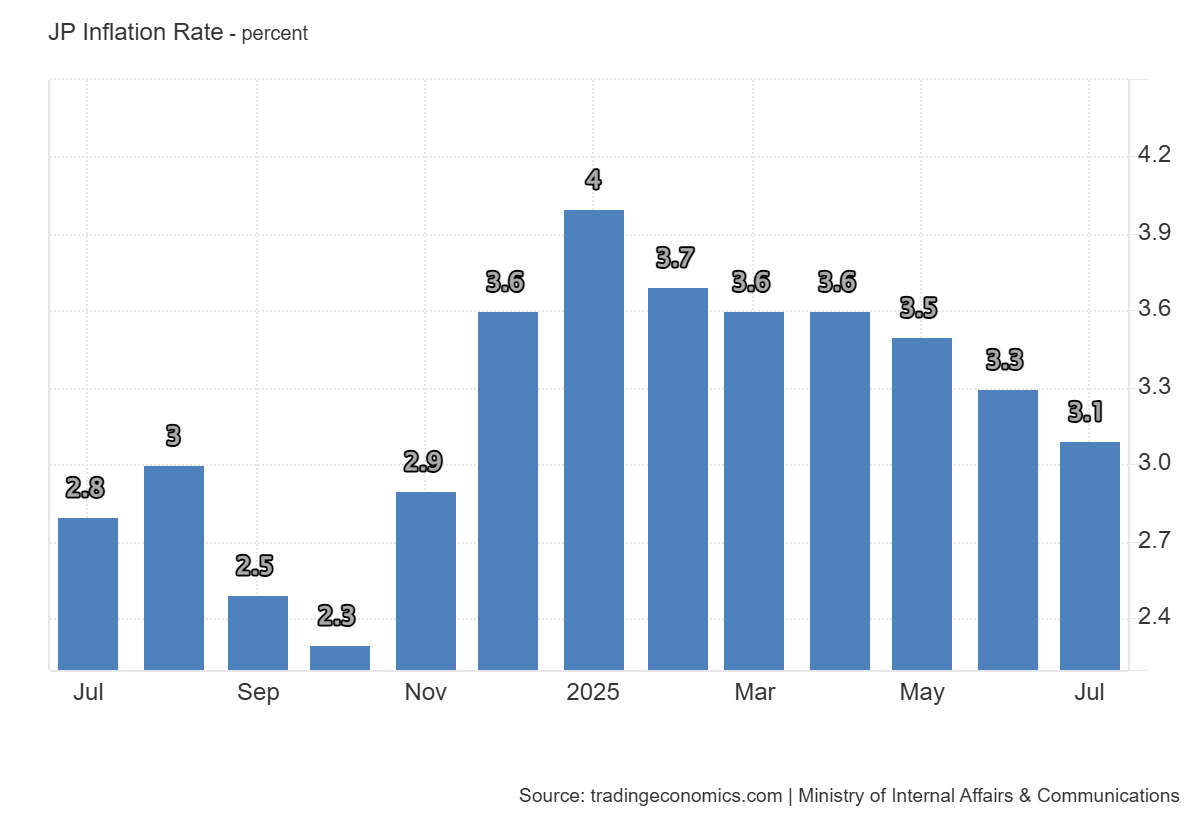

The BOJ remains focused on achieving its 2% inflation target, but rising cost of living and persistent inflationary pressures are keeping inflation well elevated at 3.1%.

BOJ Deputy Governor Himino has cautioned that the full impact of tariffs is yet to come and is expecting the BOJ to assess more data before making a move.

However, delayed rate hikes might expose the BOJ to fall behind on controlling inflation, which is a concern for policymakers aiming to balance economic growth and price stability. ⁽⁴⁾

Source: Trading Economics Japan Inflation Rate Chart

US Federal Reserve Meeting and USD/JPY Moves

The BOJ’s meeting comes after the Federal Reserve’s interest rate announcement, which is due on September 17th. The Fed is expected to cut rates due to a weak labor market.

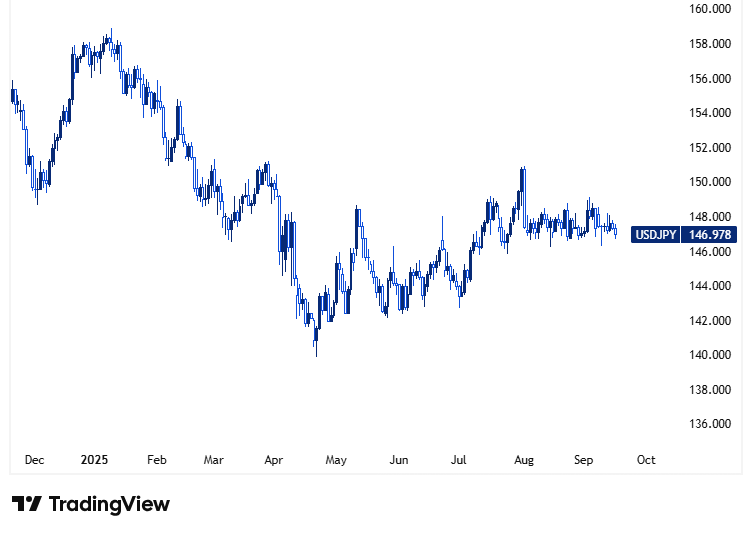

The pace of rate cuts could strengthen the yen and weaken the US dollar as a strong yen could hurt Japanese exporters’ profits, which are already hurt by tariffs, while a weaker yen could fuel inflation. This case could cause the BOJ to hike faster in order to stop inflation from rising again. The Japanese yen has risen 6.5% against the US dollar since the start of 2025. ⁽⁵⁾

Recent discussions between US Treasury Secretary Scott Bessent and Japanese Finance Minister Katsunobu Kato stated avoiding currency manipulation, with some analysts interpreting this as a signal that the BOJ should address yen weakness through rate adjustments rather than intervention. ⁽⁶⁾

Source: TradingView USD/JPY Chart

Outlook for Future Monetary Policy Changes

Despite current uncertainties, the BOJ remains open to hike rates by the end of the year, as economic data continues to align with expectations. Governor Ueda is expected to highlight the cautious and optimistic stance of the BOJ while stating risks from tariffs and US economic weakness. ⁽⁷⁾

Markets are still divided on the rate hike timing, as some market participants expect a rate hike in October while others expect more delays due to political uncertainty and global concerns. Hawkish BOJ board member Tamura has warned that high inflation could force the BOJ to act aggressively to maintain price stability. ⁽⁸⁾

The BOJ’s expected decision to hold rates steady reflects a cautious approach amid domestic and global uncertainties. While the central bank sees potential for a rate hike later this year, its next moves could depend on political developments, US economic trends, and the evolving impact of tariffs. Ueda’s upcoming briefing will be closely watched for signals on the BOJ’s future policy path.