The European Central Bank (ECB) meeting minutes for July 2025 indicated that monetary policy is in good place, stated by ECB President Christine Lagarde.

The minutes revealed that the ECB is comfortable with its current stance but is open to more rate cuts if necessary.

Despite higher standards for further easing, the ECB maintains a slight easing stance, which is driven by balanced inflation and ongoing uncertainties from trade and geopolitics.

Economic and Market Landscape

The eurozone economy showed resilience despite ongoing trade tensions with the US. Financial markets have been stabilized to a low volatile and risk-on sentiment, as they started to ignore tariff developments. The euro continued to appreciate, supported by stronger growth expectations in the EU compared to the US, and has brought inflation down.

The ECB however, noted that if trade tensions increase, it could hurt EU exports, investment and consumption, which could cause the eurozone economy to be exposed to risks. ⁽¹⁾

Growth and Inflation Outlook

The ECB’s outlook for growth and inflation indicates optimism but with caution.

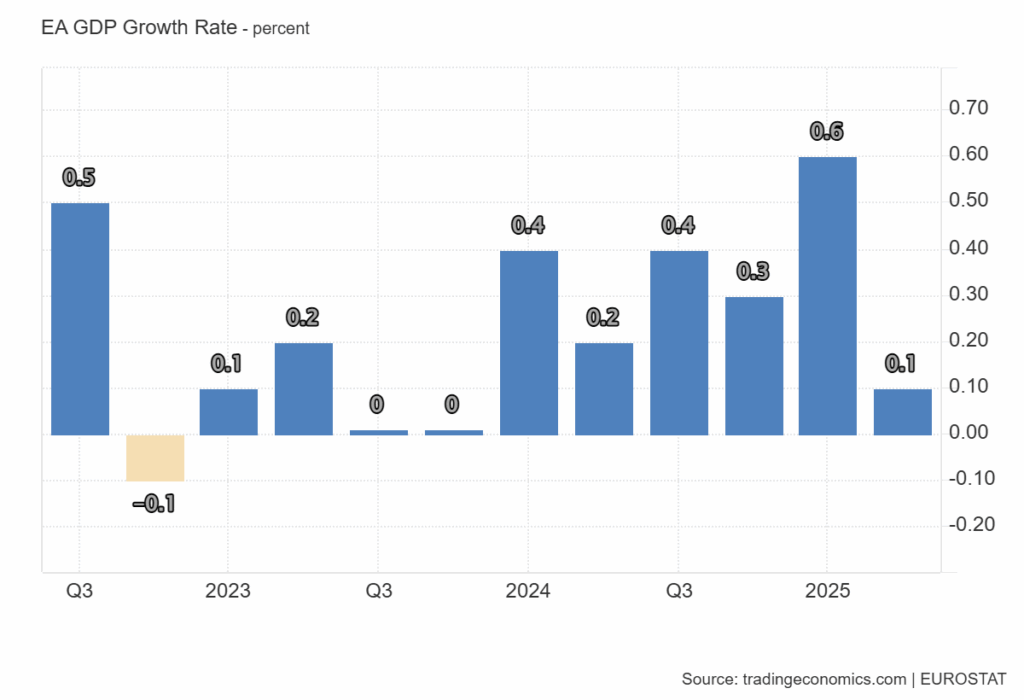

Euro area economic growth held up better than feared in Q2, which came in at 0.1% QoQ, suggesting that businesses are adapting to trade uncertainty, potentially reducing the need for more European Central Bank interest rate cuts to stimulate the bloc. Forecasts from investment banks for the euro area GDP in 2025-2026 were revised upward, signaling optimism in a recovery which could extend to 2027. ⁽²⁾

Source: Trading Economics, Euro Area GDP Chart

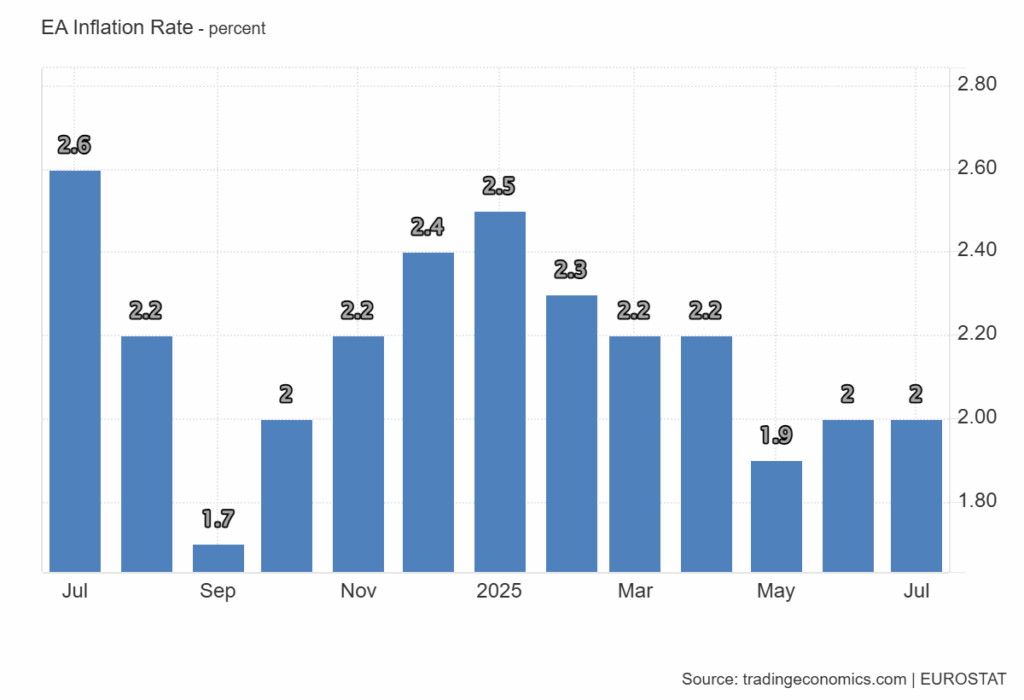

Inflation expectations for 2025 remained below previous forecasts due to lower energy prices.

Headline inflation for June and July came in at 2%, aligned with the ECB’s target, while core inflation remained steady at 2.3%. Wage growth declined to 3.8%, leading to a slowdown in labor costs. ECB forecasts for inflation in 2026 have been revised lower to 1.6% from 1.9%. ⁽³⁾

Source: Trading Economics, Euro Area Inflation Chart

Policy Stance and Future Changes in Monetary Policy

The European Central Bank has kept rates unchanged since the July meeting, stating that the central bank has become data dependent on a meeting-by-meeting basis. The minutes highlighted the reason for a cautious stance due to global uncertainties on geopolitics and trade, exchange rate volatility and energy prices. The ECB will not only focus on inflation but also surrounding risks that could pose threats to the eurozone economy. ⁽⁴⁾

The minutes revealed that at least one of the ECB policymakers has supported a rate cut in July, stating more risks for growth and inflationary pressures. The ECB’s overall stance remains cautious, with slight easing ahead, as it waits for more data to assess. ⁽⁵⁾

Despite the ECB’s wait-and-see approach, a rate cut at the September meeting might still be in play. Recent developments, including a trade agreement between the US and the EU that avoided worse outcomes, a modest second-quarter GDP growth reading, and improving business sentiment, have strengthened the case for holding rates steady. ⁽⁶⁾

However, several factors could tilt the balance toward a cut such as the French political crisis and global trade tensions.

The ECB is also preparing fresh macroeconomic projections for September, which could influence its decision. While a hawkish stance risks inflation falling below target, an “insurance” rate cut could provide support without causing harm. ⁽⁷⁾