With a new trading week comes new opportunities. So, we’ve gathered insights for the week ahead that highlight the current trends, scheduled events and potential movers to watch. Let’s get started.

Calendar Events

EU Preliminary CPI – September 2

US ISM Manufacturing PMI – September 2

AU GDP – September 3

ECB President Christine Lagarde Speech – September 3

RBA Governor Michele Bullock Speech – September 3

US JOLTS Job Openings – September 3

CH CPI – September 4

US ADP Employment Change – September 4

US ISM Services PMI – September 4

UK Retail Sales – September 5

EU Revised GDP – September 5

US Non-farm Payrolls – September 5

US Unemployment Rate – September 5

US Average Hourly Earnings – September 5

CA Unemployment Rate – September 5

Top Things to Watch

US Employment Data Set to Impact Fed’s Decision

The August US jobs report, including Nonfarm Payrolls, Unemployment Rate, Job Openings, and Private Payrolls, is due this week and could heavily influence Federal Reserve policy expectations and market sentiment. ? A strong or weak print may tilt the balance on whether the Fed moves forward with rate cuts.

Fed Independence Under Pressure

Markets are closely watching political pressure on the Fed. ⚖️ A lawsuit filed by Governor Lisa Cook, along with broader concerns about the central bank’s independence, is fueling anxiety, especially with rate-cut decisions looming.

Court Rules Trump’s Tariffs Illegal

?️ A federal appeals court ruled that most of Trump’s “reciprocal tariffs” were illegal, saying he exceeded his authority. Originally covering 69% of US imports, ? the levies could shrink to around 16% if overturned. For now, duties remain in place until October 14th, pending a possible Supreme Court appeal.

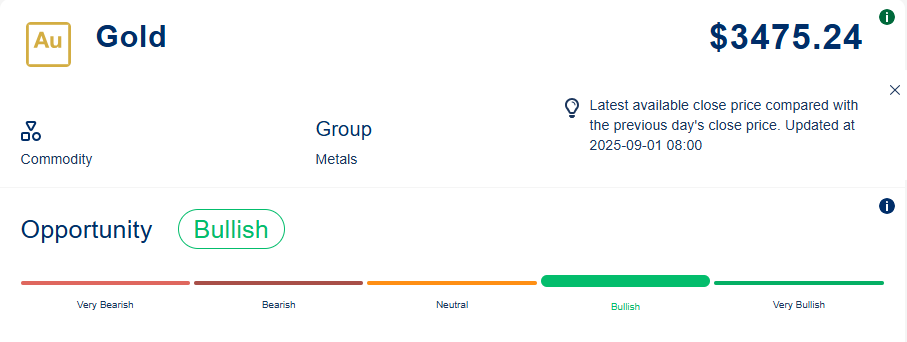

Trending Now: XAU/USD

Source: Acuity

Source: TradingView

Why It’s Trending?

Gold extended its rally for a fourth straight session, pushing toward multi-month highs near $3,480. The surge comes as traders raise bets on a potential Fed rate cut in September, following softer US inflation data measured by the PCE index. Safe-haven demand has also been buoyed by rising geopolitical tensions and renewed concerns over the Fed’s independence.