Preliminary PMI data from the Eurozone, UK and US showed reversed trajectories, with the Euro area showing an expansion in manufacturing for the first time since April 2022, while the UK continued to show momentum in the services sector.

The US has indicated the strongest growth momentum, with manufacturing expanding to its highest level since May 2022 and services continuing to grow.

US Shows Strong Demand and Tariff-Driven Costs

The US economy is still showing signs of resilience after the composite PMI rose to 55.4, reaching an 8-month high, with both services and manufacturing showing signs of strength. ⁽¹⁾

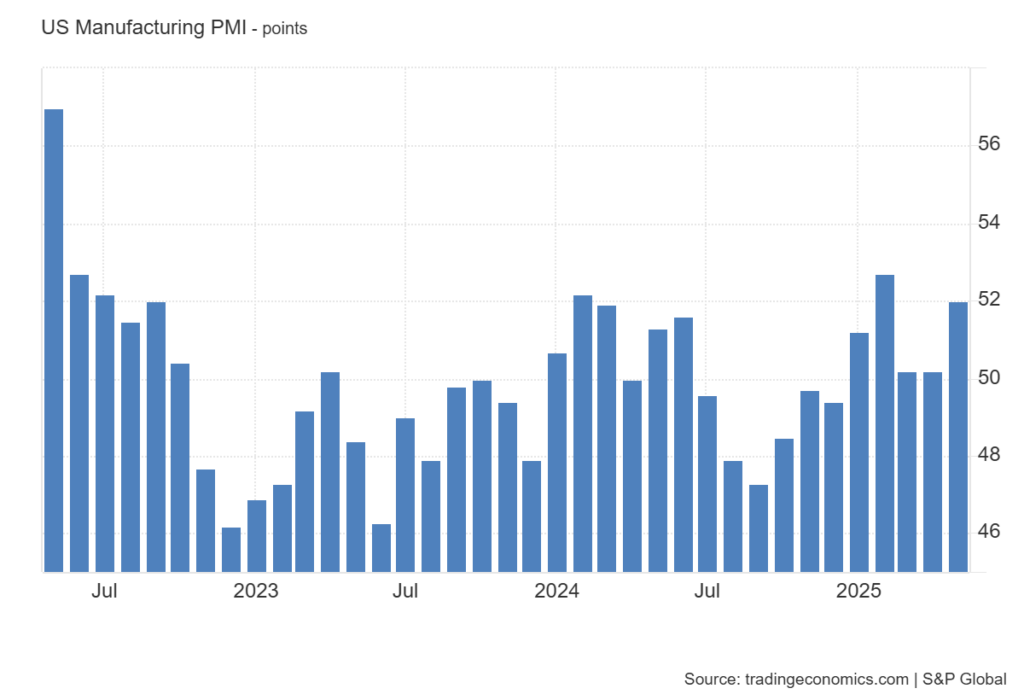

The latest reading signaled a renewed improvement in factory business conditions after a brief deterioration in July. August’s reading was the highest since May 2022.

Source: Trading Economics: Showing Levels of Manufacturing PMI Since May 2022

Production rose for a third successive month, rising at its highest level since May 2022 and supported by the largest inflows of new orders since February 2024. Factory employment meanwhile rebounded after a decline in July to register the largest payroll gain since March 2022. Export sales grew for the first time in 15 months. ⁽²⁾

Due to inflation, businesses have passed their higher costs onto consumers, leading to the fastest pace in selling prices in three years, largely driven by tariffs and rising input costs.

Euro Area Shows Signs of Recovery

The Eurozone’s PMI indicated a slow recovery in August. The composite PMI rose to 51.1, its highest level in 15 months, with manufacturing expanding to its fastest pace in three years at 50.5.

New orders also showed signs of expansion, the first time also since 2022. These factors indicate that the industrial sector is stabilizing after a long contraction. ⁽³⁾

However, exports remain weak, with foreign orders extending declines, due to ongoing trade challenges. Inflationary pressures picked up, with both input and output processes rising at faster paces, which might indicate that persistent inflation might return. Services PMI remained in expansion territory but below the July level. ⁽⁴⁾

For the ECB, the results could create complications to its policies, as growth is improving but inflation is not falling at the pace they expect.

UK Shows Mixed Result

UK PMI showed mixed results, with the composite index reaching 53, the strongest in a year, with services continuing to show promising results. However, manufacturing continues to contract, showing a figure of 47.3 as factories are struggling with weak demand and export challenges due to US tariffs. Services came in at 53.6, continuing its strong momentum. ⁽⁵⁾

Rising levels of optimism were seen in both the manufacturing and service sectors in August. Service providers linked growth expectations to forthcoming business investment and product diversification plans, alongside an anticipated revival in domestic consumer spending. ⁽⁶⁾

Manufacturers again noted caution about the outlook for global trade due to US tariff uncertainty, but many commented on hopes of a rebound in customer demand.

Market Reaction

EUR/USD and GBP/USD both rose 0.24% after the release of their PMI data, but then removed their gains due to strong US PMI data, with both declining 0.46%. Gold also removed earlier gains, declining 0.26% around the release of the US PMI data.

The PMI data suggested something interesting. That the rise in global business activity, especially in the US, EU and UK, could fade dovish expectations from central banks due to the strong activity, potentially leading to a stronger US dollar, higher bond yields and cautious sentiment in stock markets.