With a new trading week comes new opportunities. So, we’ve gathered insights for the week ahead that highlight the current trends, scheduled events and potential movers to watch. Let’s get started.

Calendar Events

UK Unemployment Rate – Sept 16

UK Claimant Count Change – Sept 16

CA CPI – Sept 16

US Retail Sales – Sept 16

UK CPI – Sept 17

EU CPI – Sept 17

BoC Interest Rate Decision – Sept 17

Fed Interest Rate Decision – Sept 17

NZ GDP – Sept 18

AU Unemployment Rate – Sept 18

BoE Interest Rate Decision – Sept 18

JP CPI – Sept 19

BoJ Interest Rate Decision – Sept 19

UK Retail Sales – Sept 19

Top Things to Watch

Central Bank Announcements

This week’s spotlight will be on central bank decisions, with traders closely watching for fresh policy signals. ? The Federal Reserve is widely expected to cut rates on Wednesday, followed by meetings by the Bank of Canada on the same day, the Bank of England on Thursday, and the Bank of Japan on Friday. These meetings could shape the outlook for monetary policy and set the tone for global markets, ? driving moves in currencies, commodities, and equities.

Global Tariff Updates

Recent tariff developments have been creating more damages to global trade. The US is pushing G7 countries to impose high tariff rates on China and India due to purchases of oil from Russia, while Mexico raised its tariff rate on Chinese manufactured cars ? and other imports to protect local manufacturing. These moves, combined with existing tariffs from the US, are contributing to inflationary pressures and increasing uncertainty for global markets and supply chains. ��

Meta Conference

Meta CEO Mark Zuckerberg will start the company’s annual Meta Connect conference with a keynote. The Facebook parent is expected to focus attention on product offerings like its AI glasses. ? The social media giant is devoting significant resources to AI, including big paydays for top talent.

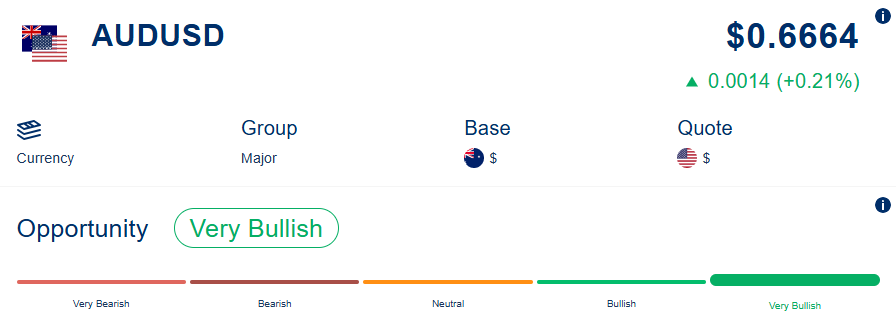

Trending Now: AUD/USD

Source: Acuity

Source: TradingView, AUDUSD Price Chart

Why It’s Trending?

AUD/USD rose to 10-month highs, supported by upbeat Australian data and weak US jobless claims, which have raised hopes for Federal Reserve rate cuts. Strong Australian domestic data, including rising consumer inflation expectations and firmer household demand, have reduced expectations of further RBA rate cuts, supporting the AUD.