Nvidia, now the world’s most valuable company, takes center stage today as it prepares to unveil its Q2 earnings.

Analysts are looking for another blockbuster report, with traders watching closely to see if the chipmaker can keep its AI-fueled momentum alive despite mounting trade pressures from China.

Wall Street Estimates

- Earnings Per Share: $1 per share, up 47% YoY

- Revenue: $45.81 billion, up 52% YoY

Since 2023, Nvidia has led the way in AI innovation, as the chipmaker’s revenue has more than tripled and profits have quadrupled. The stock is up 33% YTD. ⁽¹⁾

Nvidia’s fiscal second-quarter earnings report, scheduled after the closing bell, could mark the second anniversary of growth if results turn out positive.

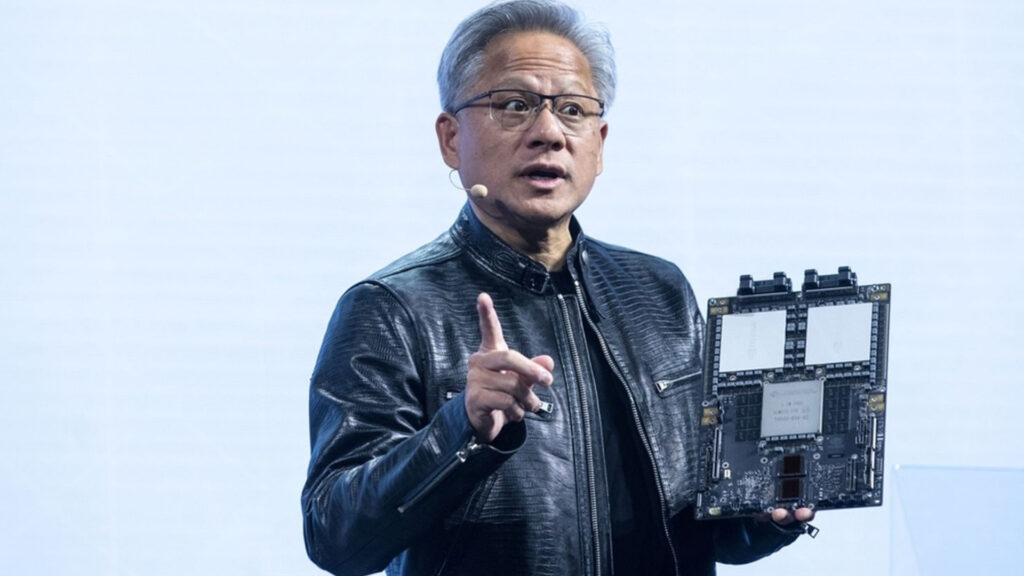

The company has shifted from being known as a maker of gaming chips to its current position at the heart of the tech industry. ⁽²⁾

Last month, Nvidia became the first company to hit a $4 trillion market cap, and its stock has continued to appreciate. Since the end of 2022, around the time OpenAI launched ChatGPT and sparked the generative AI boom, Nvidia’s stock price is up twelvefold. ⁽³⁾

Key Factors to Watch

Tech Leadership and Product Innovation

Nvidia remains a leader in the tech industry with an aggressive product strategy. The latest Blackwell chips are highly demanded in AI workloads, as production of the Blackwell chips were sold out in advance.

As more Blackwell chips get installed, experts anticipate that their superior computing power will enable companies like OpenAI and Anthropic to create even more capable AI models. OpenAI’s GPT-5, which was announced earlier this month, was trained on Nvidia’s last-generation Hopper chips, not the newer Blackwell processors. ⁽⁴⁾

During the earnings call, CEO Jensen Huang might share some updates on Nvidia’s other product lineup such as the Rubin, with the Blackwell product lineup included.

China Concerns

Nvidia faces challenges from the US government, where it has applied export curbs on China, which led to a loss of $8 billion in revenue. Nvidia has secured a deal with the US government, agreeing to share a portion of 15% of its sales with the US government to continue its sales of its H20 chip in China. ⁽⁵⁾

Nvidia’s leadership might also discuss their new chip, tentatively named B30A, that it is reportedly developing for China. The new chip is said to be based on the company’s Blackwell architecture and would be more powerful than the H20. ⁽⁶⁾

Strategic Partnerships

Nvidia’s partnerships are likely to have an impact on its earnings, especially through its AI and data center business. Partnerships with companies such as Humain in Saudi Arabia could drive demand higher for Nvidia’s high performance GPUs. ⁽⁷⁾

These partnerships could also lead to higher profits for the company, with the scaling of AI infrastructure and Nvidia technology into global enterprise solutions.

Successful global adoption of Nvidia-powered AI platforms could enhance the company’s pricing power, enabling higher-margin products in both AI and industrial markets, which would further support overall earnings growth in upcoming quarters. ⁽⁸⁾

Forward Guidance

Nvidia’s forward guidance for future earnings continue to show strong growth in revenue, despite geopolitical developments such as export curbs to China. The company expects solid results, which are supported by high demand in AI chips, especially the Blackwell lineup, which has led to strengthened strategic partnerships. This outlook indicates Nvidia’s leadership position in the AI infrastructure sector and its resilience amid geopolitical and market uncertainties.

Bottom Line

Nvidia’s Q2 earnings are highly expected to outperform as it tests investors’ faith in AI innovation. Despite trade concerns, analysts maintain a positive outlook on the stock as it continues to outperform the market and shows dominance in the tech industry.

Investors will wait for Nvidia’s result and are eager to see if the chipmaker can continue to sustain growth.