With a new trading week comes new opportunities. So, we’ve gathered insights for the week ahead that highlight the current trends, scheduled events and potential movers to watch. Let’s get started.

Calendar Events

US Consumer Confidence – August 26

AU Consumer Price Index – August 27

CHF Gross Domestic Product – August 28

US Prelim Q2 GDP – August 28

Tokyo Consumer Price Index – August 29

CA Gross Domestic Product – August 29

US Core PCE Index – August 29

Top Things to Watch

Nvidia Earnings

Nvidia’s earnings report is among the most anticipated this week, due on Thursday, August 27 after the closing bell. As a flagship player in the AI and semiconductor space, its performance could sway investor sentiment on the AI-driven rally. Market watchers are particularly focused on details about its China exposure, product pipeline updates and guidance in light of geopolitical and export restrictions.

Core PCE Index

Friday brings the release of the Personal Consumption Expenditures (PCE) price index, the Fed’s priority inflation gauge. This will be critical in shaping expectations ahead of the Fed’s September meeting.

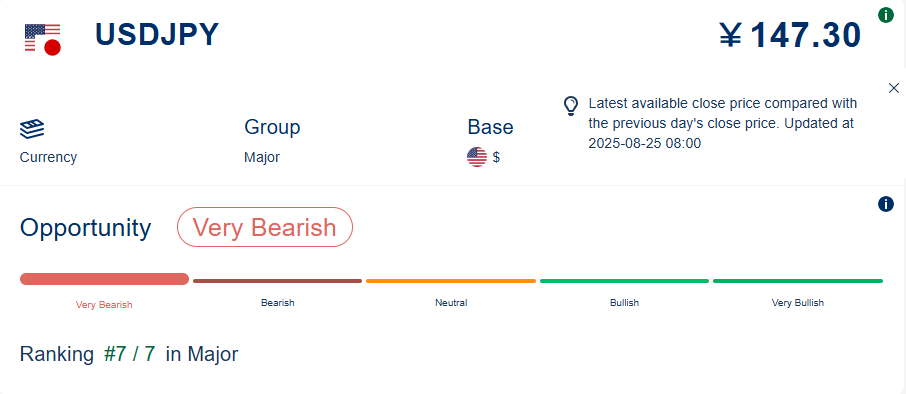

Trending Now: USD/JPY

Source: Acuity

Source: TradingView

Why It’s Trending?

USDJPY dropped 1.4%, reaching a 2-week low during Fed Chairman Powell’s speech at the Jackson Hole symposium, indicating that rate cut expectations are active due to the weak labor market data. The currency pair might continue its trend downwards if US data continue to reinforce more dovish signals from the Fed.

On the Japanese front, BOJ Governor Kazuo Ueda said accelerating wage growth and labor shortages strengthen the case for a rate hike later this year, which could support the Yen even more.