With a new trading week comes new opportunities. So, we’ve gathered insights for the week ahead that highlight the current trends, scheduled events and potential movers to watch. Let’s get started.

Calendar Events

- CAD CPI – August 19

- NZD Interest Rate Decision – August 20

- UK CPI – August 20

- US FOMC Meeting Minutes – August 20

- EU Manufacturing & Services PMI – August 21

- UK Manufacturing & Services PMI – August 21

- US Manufacturing & Services PMI – August 21

- Fed Chair Powell Speaks at Jackson Hole Symposium – August 22

Top Things to Watch

Fed Chair Powell’s Speech at Jackson Hole Symposium

All eyes are on Federal Reserve Chair Jerome Powell as he speaks at the Jackson Hole Economic Policy Symposium on August 22nd. Financial markets will be looking for insights on whether the Fed may signal interest rate cuts amid mixed economic data. Markets are also focusing on the FOMC Minutes due to come out on August 20th, which could reveal internal divisions.

Peace Talks Remain on Edge

Ukrainian President Volodymyr Zelensky and European leaders will visit the White House on August 18th after President Trump backed Russia’s proposed peace deal requiring Ukraine to cede territory. The move follows Trump’s meeting with Vladimir Putin in Alaska, where he appeared to accept Russia’s approach, alarming Kyiv and its allies. Oil and gold markets will be watched by traders.

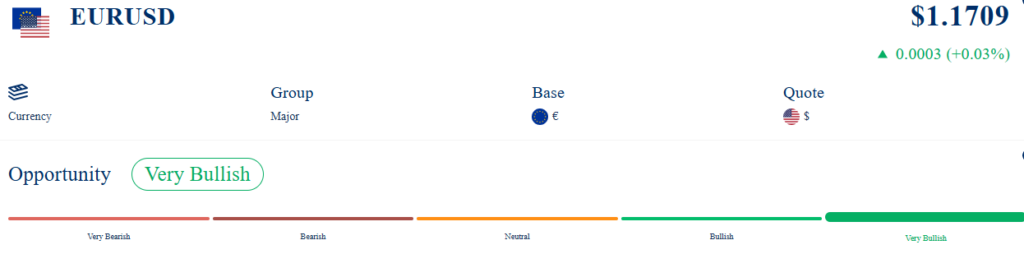

Trending Now: EUR/USD

Source: Acuity

Source: TradingView

Why It’s Trending?

EUR/USD has continued to rise, approaching July highs as risk-on sentiment and rising speculation of a rate cut from the Federal Reserve continue to pressure the US dollar. Soft inflation and a weak labor market also support the case for a rate cut. The Euro has surged 8% this year, rising to 4-year highs, also supported by EU fiscal policies and US trade uncertainty.

Get ready for an exciting week of trading! As always, if you have any questions, remember our dedicated team is here to support you along the way.